Week 17: Break, Focus, Family and a lot to do

Dealing with Omicron, the future, crisis and opportunities

I took a break from writing this newsletter. First, because I was sick with Omicron and tonsilitis, and then because there was so much to do, I had to cut many topics from my ToDo List. More on this later.

The last few months were intense.

The war in Ukraine is overshadowing so much, and I hope the suffering will end as soon as possible. Both betterplace.org and Berliner Stadtmission, the non profit organizations I support (betterplace as a co-founder and Berliner Stadtmission as a member of the board of trustees), are helping the Ukrainian people.

I spent the year-end holidays in bed with Omicron and tonsilitis and needed January to recover. I took a week off hiking in Madeira to recharge my batteries in February. After my return, there was a lot of work to do, and then the war in Ukraine broke out. I did not feel like writing and focussed on my family and working. Not writing does not help me at all. So here we go:

Being remote-first

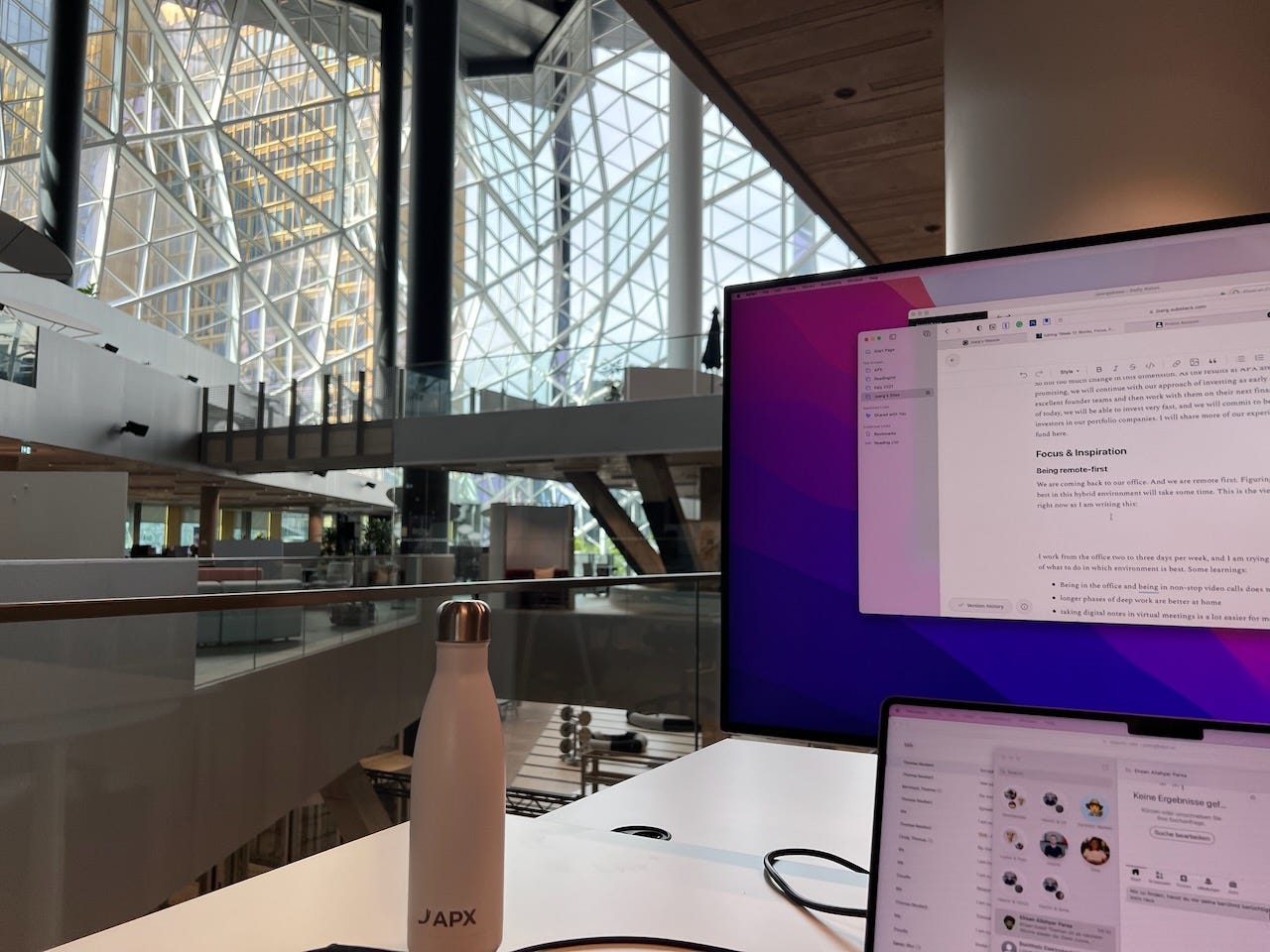

We are coming back to our office. And we are remote first. Figuring out how to work best in this hybrid environment will take some time. Check out the view from my desk right now as I am writing this:

I work from the office two to three days per week, and I am trying to find my rhythm of what to do in which environment is best. Some observations and learnings:

Being in the office in non-stop video calls does not make sense. My home infrastructure is so much better for this.

Longer phases of uninterrupted deep work are better at home.

Taking digital notes in virtual meetings is easier for me than in real-person meetings.

Synchronous and asynchronous days help me to get more done. I switch weekly—more on this next week.

My colleagues and I have different “rhythms” of being in the office. In the past the office was the space to connect by default. This has changed. Not sure yet, what our place to connect is now.

Some of my colleagues are not living in Berlin anymore. I do not notice any negative effects of this.

We are working on our “rhythm” as a company:

We have quarterly team offsites where we ask everyone to attend.

Once per month we take a walk and eat together. Participation is optional but quite a lot of us joined.

Once per week we have lunch together. This is optional and everyone who is in the office joins.

We have multiple social and fun activities. All are optional and depending on the “life situation” of us we participate or not. It is super nice to see what gets organized.

Events are coming back and real life meetings are happening again. I find them quite intense because my sensors are adjusted to “reading” virtual meetings. It’s a bit of a sensual overflow for me to be in multiple person meetings. Events are extra intense for me. I also need to accommodate “traveling” time into my calendar again. I cannot “click” myself from meeting to lunch to desk.

APX and the new fund

Henric and I have been starting to raise funds for our next fund. As APX is turning five years old at the end of the year and we will be switching to investing in portfolio companies only, we have been working on our future: we are raising a venture capital fund. Axel Springer and Porsche will (most likely😉) be our anchor investors, and we are talking to other LPs as well.

Henric and I have been working together for more than five years. We have such a deep trust in each other that we want to continue together. When we resonated our idea of a more traditional VC fund with our current APX shareholders, they luckily liked the idea as much as us and were ready to commit fast.

Working with my colleagues at APX is going well, and together, we are convinced we can support the European startup eco-system in the future with our investment and support approach.

We have spent the last few weeks improving and further building our fund model on the experiences we made over the past years, and we will continue to invest very early. So not too much change in this dimension. As the results at APX are looking promising, we will continue with our approach of investing as early as possible in excellent founder teams and then work with them on their next financing rounds. As of today, we will be able to invest very fast, and we will commit to being long-term investors in our portfolio companies. I will share more of our experiences raising a fund here.

What I read and watched:

I have read so much and watched so many videos. Here is a selection of the ones that resonated with me:

How Covid changed business travel forever. I think the combination of Covid and awareness for our environment and a desire to be more sustainable have significant impact on how we work. At least in some fields of business.

Pavillions at the Venice Biennale (still not sure if I will go). I love art and I love venice. I might do a Europe traintrip in summer with my wife. Venice could be a nice stop.

Lots of resources for the Mochary Method. In case you are building a company, this could be very helpful. A great collection of links and tools.

How to get faster through my inbox. Is a text by the founder of superhuman, my favorite email client since quite some time.

When to Sell: Creating Rules for taking profits. I have been a subscriber to Every.to since a few months. I love their content that arrives in form of several newsletters. This is one of them. The others are absolutely worth checking out.

Shortcuts in the Wild: Ulysses is a piece about how to use automation and Ulysses on the road. I found it very interesting to read but have not yet build something like this for my publishing workflow.

Why you probably should not buy a monopod. Camera Conspiracies on youtube.

Ellen Alien Boiler Room x Dommune x Technics on YouTube.

It looks so easy: How to make 29 handmape pasta shapes on YouTube

Korean BBQ steaks at scale: korean street food on YouTube

I hope you found something meaningful in my newsletter and (at least for me) it feels very good to write again.

Have a great week!

Joerg